Characteristics of the currency pair GBP/USD

What are currency pairs?

In forex, the currency pair is the main trading instrument. Trading currency pairs, which allowed everyone to profit from the differences in exchange rates, had become relevant since the inception of the Forex market in 1978 when the IMF officially allowed national currencies to delink from the dollar and gold reserves.

In the Forex market, currency pairs are sometimes called 'trading pairs', which is true because they are used for trading, i.e., exchange one national currency for another. More specifically, buying one for the face value of the other. As is clear from the word "pair", we talk about two assets written down sequentially. Therefore, the order of the currency in the entry is of conceptual importance for trading currency pairs.

The currency unit that is recorded first (standing on the left) is called the base currency. Please note - there is no such thing as "base currency pairs", only base currencies, and each pair has its base.

The monetary unit that is written second (standing on the right) is called the quoted unit. This name defines the relationship between the two parts of the entry because the right side is mentioned about the left side.

Deciphering currency pairs is an essential skill for novice traders. The symbols for EUR/USD, GBP/JPY, GBP/USD and others. Essentially, they are their abbreviated names. For example, to avoid writing Deutsche Bank, its abbreviated ticker is DBK.

Example of currency pair calculation

The most popular currency pair is EUR/USD. The correct notation is EUR/USD. In Forex, trading pairs are recorded using their international letter names, regulated by the International Organization for Standardization (International Organization for Standardization, or ISO for short). This is done to simplify trading - traders worldwide use the same designations and always know which pair is in question.

For the calculation, we will take the notional exchange rate EUR/USD=1.18. This is a typical exchange notation for currency pairs. To read it correctly, you need to understand the principle of currency trading in Forex - the base currency is bought for the quoted currency. In our case, the trader buys 1 euro for $1.18. Thus, the left position in the entry is the commodity (euro), and the right is the price (dollar).

The principle is obvious and appeared long before the birth of the Forex market. For example, people who knew only natural exchange could exchange a flint spear for two wolfskins in ancient times. In the Stone Age "currency pair table", this barter would be written as follows: spear/wolfskin = 2.

Note that the quote that comes after the name of the currency pair (the number after the sign) always refers to the amount to be paid in the quoted currency to buy one unit of the base currency. So, for example, always one unit for one US dollar, not ten, not one hundred dollars, for one.

Trading sessions

A trading session is when an exchange trades on a particular exchange or exchanges in the same region. There are set opening hours for every exchange in the world. This is the leading trading session during which official trading occurs. Stock exchanges are open daily from Monday to Friday; public holidays and Saturdays and Sundays are days off.

In addition to the main session, there are two further periods, the pre-market and the after-hours, in which traders can place orders, although there are specific rules and restrictions during these times.

- Pre-market is the time before the main trading session when transactions are executed with a counter offer.

- After-hours are when the trading session is closed, designed for settlements between brokers and traders carrying out REPO operations, transferring margin positions to the next trading day.

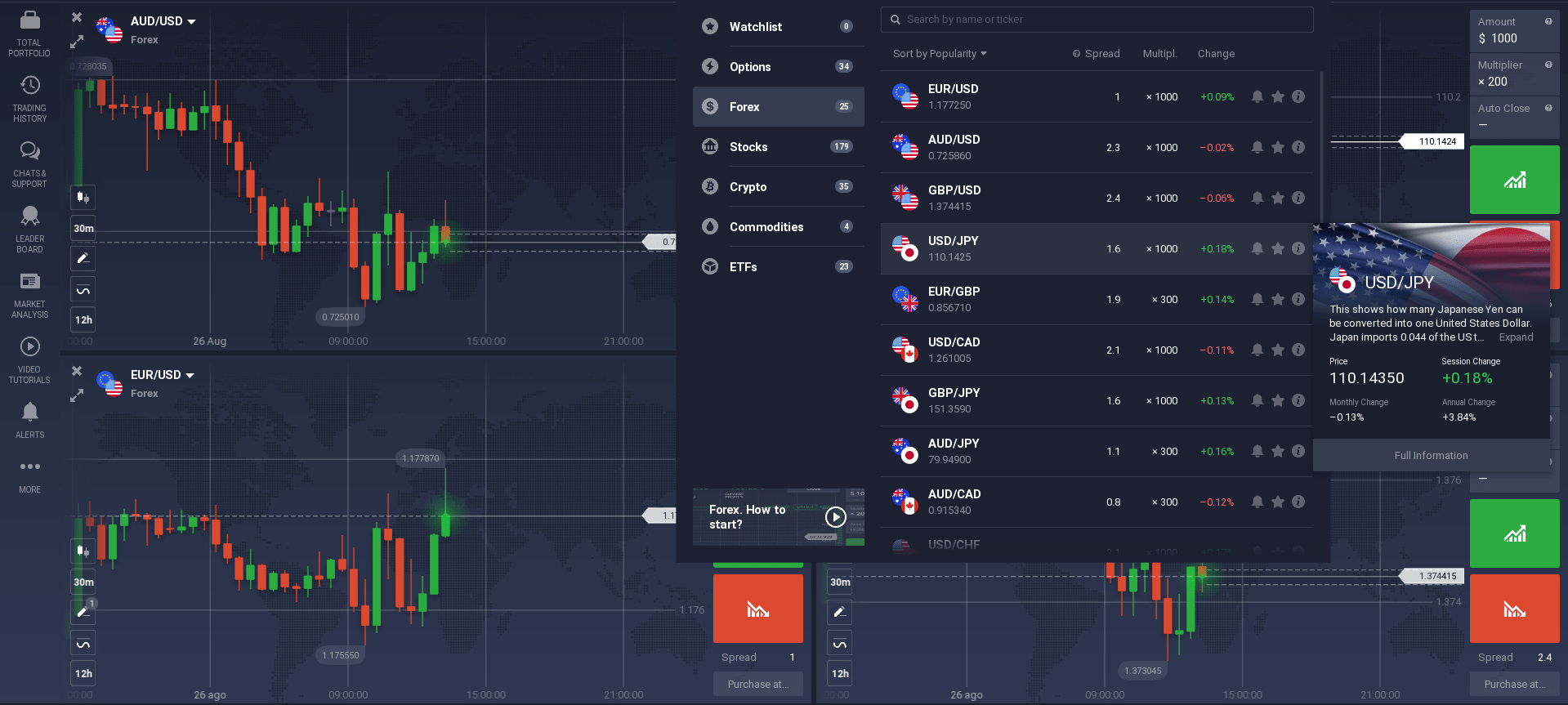

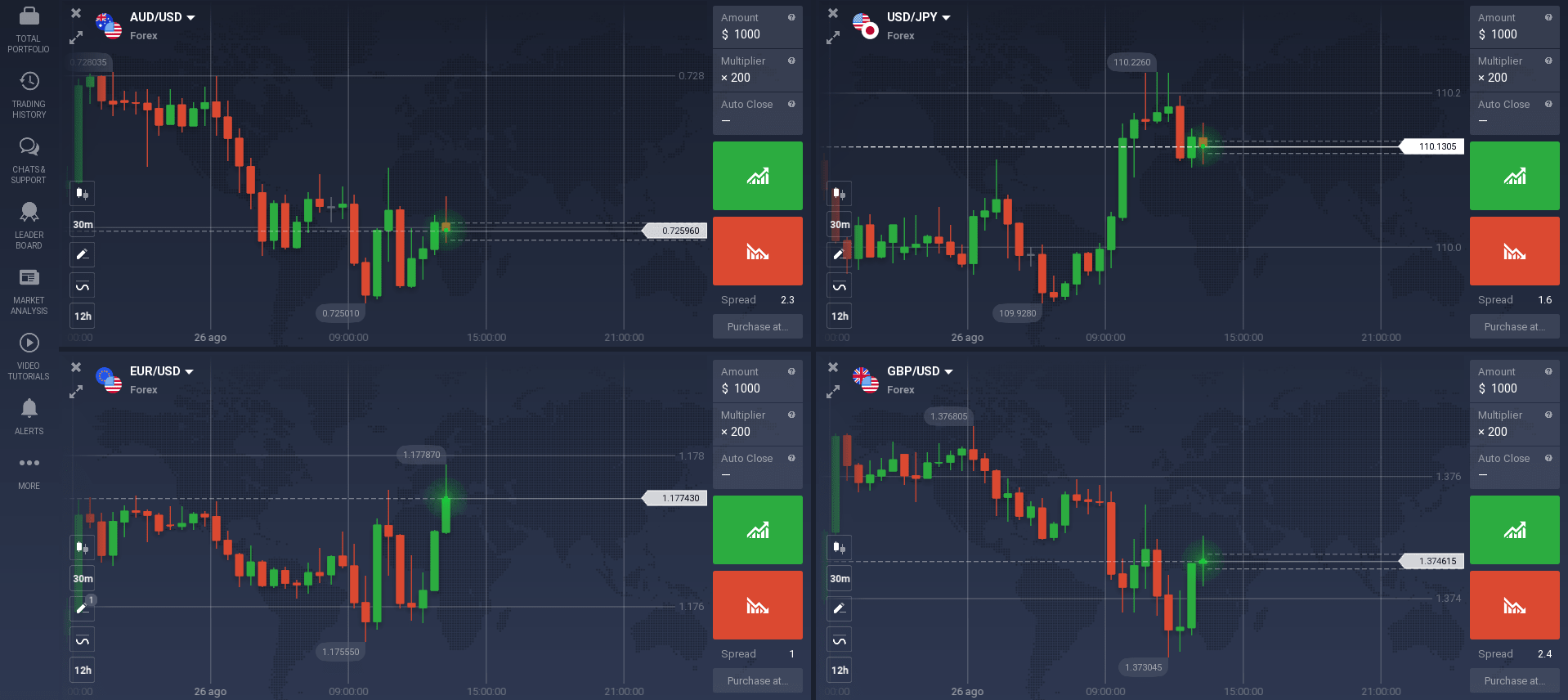

A trading session in the Forex market lasts 24 hours a day. However, traders consider the main trading hours of the world stock exchanges because it influences the volatility of the instruments related to a particular region. For example, during the European session, the most actively traded currency pairs with the euro and the pound sterling. The Japanese yen, the Australian dollar, and the New Zealand dollar during the Pacific and Asia.

Trading time frames

A time frame is an interval of time that is used to convert quotes (the current price of an asset) into chart elements. It allows the trader to see how the price changed within this interval. The timeframe is represented in the form of ready-made components - it can be points on a line chart, bars or Japanese candlesticks.

The designation of timeframes

A number and a Latin letter indicate a timeframe. The letter indicates the period of the chart (minute, day, month, week or year), while the number indicates the number of such periods in the displayed chart element (for example, 10 minutes or two years).

- M is a minute (e.g. M10 is ten minutes).

- H is an hour (e.g., H4 is four hours).

- D or Daily is a day (e.g., D1 is a daily period).

- W or Weekly is a week (e.g. W1 is one week).

- MN or Monthly is a month (e.g. MN1 is one month).

- Y is a year (e.g. Y1 is one year).

Elements of high timeframes are composed of parts of low ones. In other words, you can encircle with a rectangle four elements of the time frame H1 (one hour) and get all information displayed on the time frame H4 (4 hours).

- 1 minute - M1;

- 5 minutes - M5;

- 15 minutes - M15;

- 30 minutes - M30;

- 1 hour - H1;

- 4 hours - H4;

- One day - D1 or Daily;

- One week - W1 or Weekly;

- One month - MN or Monthly.

Sometimes you may find time frames in a different breakdown: M10, M20, H2, Y (year) and others. In addition, on some platforms, there are software tools that allow you to create a non-standard timeframe yourself.

The name of the timeframe denotes the value of its minimum element. Elements of higher time frames are made up of parts of lower time frames.

Short term trading

Advantages of the short term trading include:

- Active intraday movements. On small timeframes, the price can move a lot, thus allowing the trader to trade every day.

- Quick experience gain. Because opportunities occur every day, a trader can quickly gain trading experience and test the effectiveness of the trading system.

- High-profit potential. Due to the high intraday volatility, short term trading has high-profit potential. Profits can be made both on descending and ascending intraday movements.

- There is no risk in moving positions overnight. Since most trades are closed within one day in short term trading, there is no risk of an overnight rollover.

But short term trading has its disadvantages:

- Fast, challenging to predict market movements. In short term trading, the market may turn around in a minute. Accordingly, a trader has to be constantly attentive and focused, which is rather tricky for a long time.

- It is necessary to watch the market several hours a day. This type of trading is more suitable for professional participants who can spend 8 hours a day trading. It may be not easy to combine this type of trading with another job or business.

A general rule of thumb for choosing the best timeframe

We are accustomed to thinking that we have to start from small steps when starting any new business. Thus, we make one mistake fraught with dire consequences in trading - we begin with small timeframes. But beginners should study larger time frames first.

While D1 is a universal timeframe, suitable for beginners and expert traders alike, in the h1 - h4 range, do not go below h4 if you are a beginner, m5 - m15 - suitable for experienced traders.

You may use any timeframe for technical analysis of the market. A higher timeframe will give you direction, while smaller time frames will provide you with entry points.

So the answer to which timeframe to trade on is obvious for beginners - you need to know how to orientate in all time frames to choose the best one for yourself.

Only such comprehensive work will allow you to make a first-class trade.

Trading strategy

Undoubtedly, traders are looking for the perfect trading strategy that works on high returns and minimal risk. Unfortunately, however, there is no ideal strategy. Nevertheless, several optimal programs will help beginners get a stable profit of average size from the first deal.

Candlestick reversal

One of the simplest and yet the most effective forex trading strategies is the reversal candlestick strategy.

The candlestick reversal strategy works fine for any time frame and a variety of financial assets. The main objective is to identify candlesticks and calculate the potential for changes in the trend. For example, if the depth of the momentum decreases, a reversal is likely to come, or a rate pullback will occur. Thus, the fundamental trading principle is in high demand among traders and brings good profits.

Every day up to fifteen signals are fixed for investment. A candlestick is detected on the analyser, and then the trend line is expected to change. At the moment, the trendline weakens, trades are made.

The strategy will allow earning small sums of money each time you visit the terminal.

It is essential to have a good knowledge base before applying this tactic. If the user draws false lines of resistance and support and trading figures are far from ideal from didactic materials, the deposit will be ruined. When drawing the lines, it is worth taking into account the short periods.

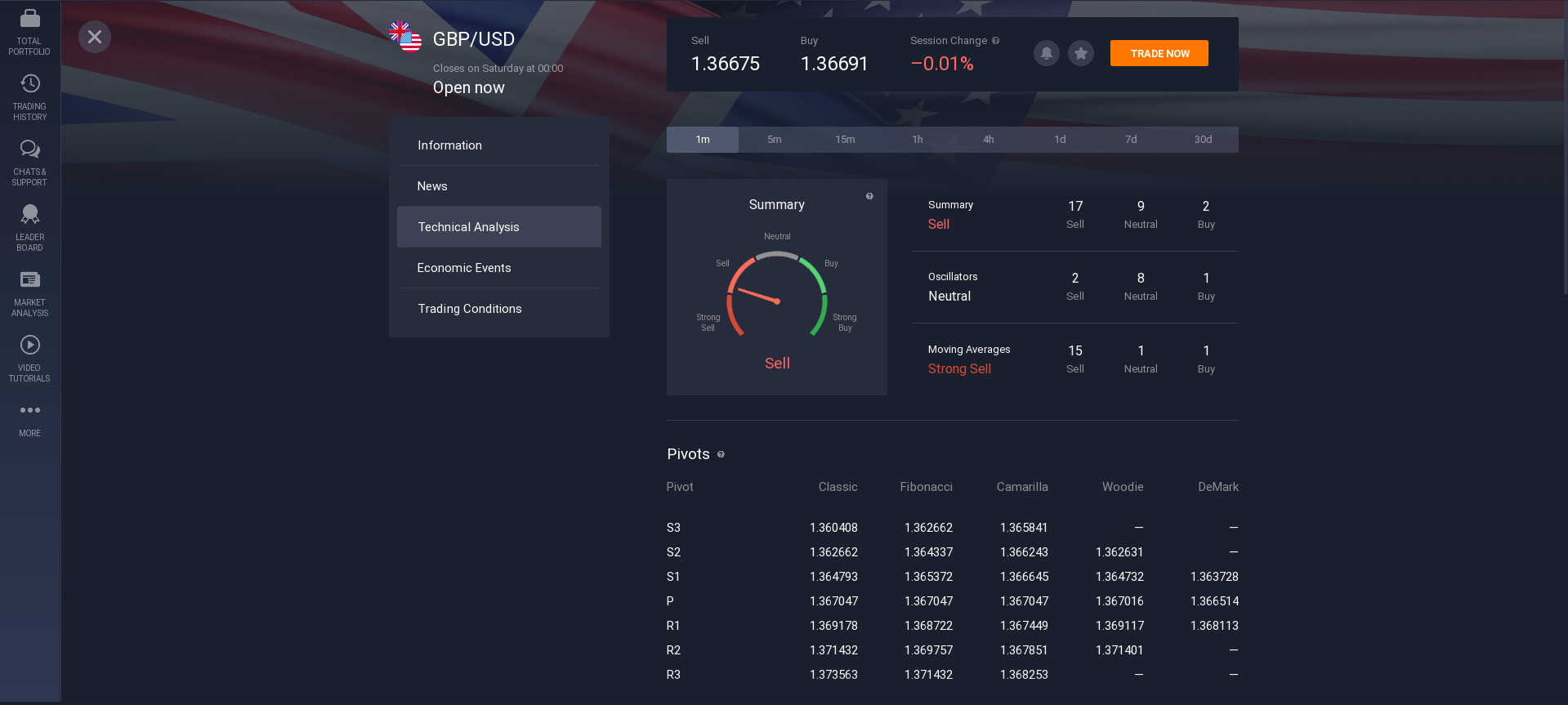

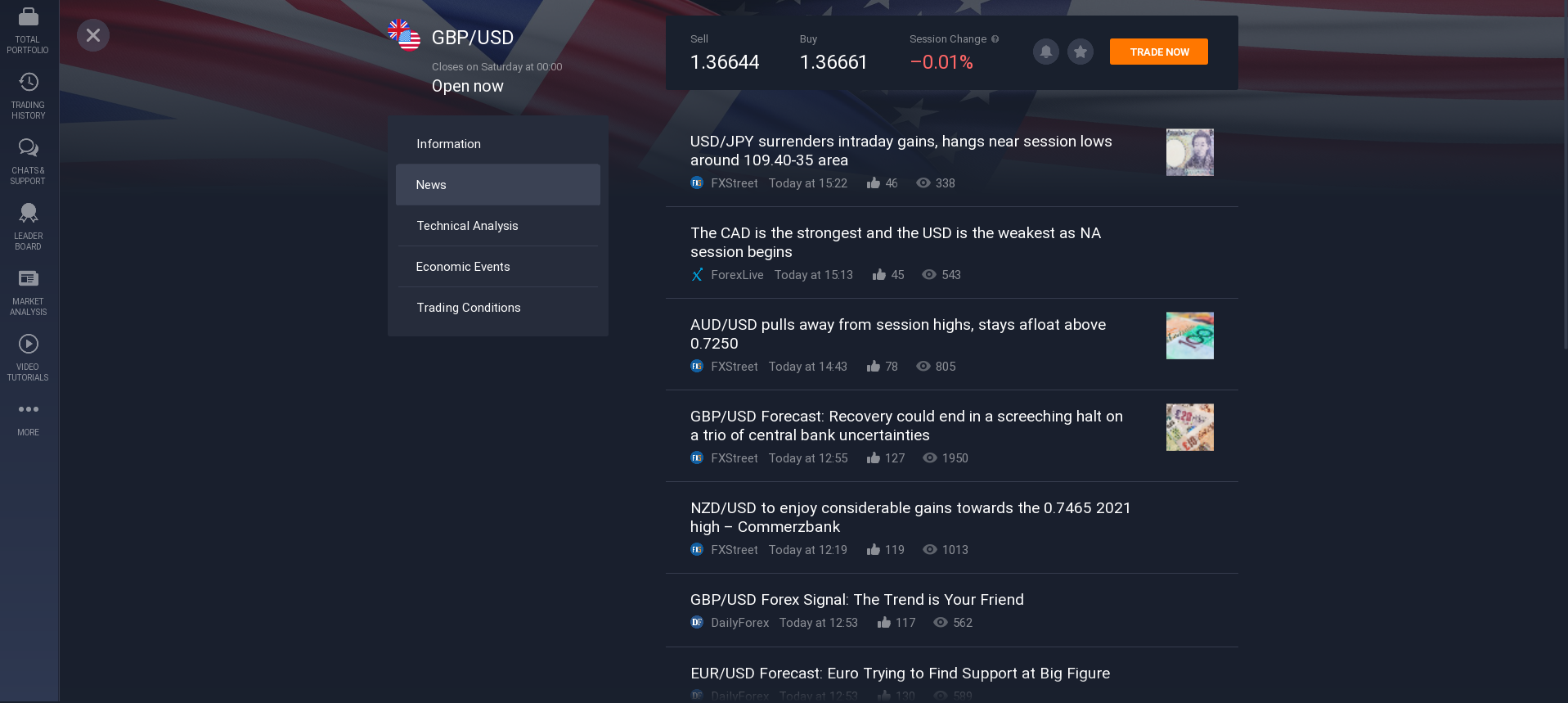

Features of the currency pair GBPUSD

The pound dollar currency pair is relatively standard in the forex market. The pound is the third most popular currency pair. Its turnover is about 12% of the total turnover of currency pairs. This is why knowing the behaviour of the instrument and knowing the periods that are the most favourable for trading is especially important, especially for beginners.

This instrument's base currency is the British pound (GBP), while the quoted currency is the US dollar. The pair is mentioned in a straight line and joins the group of "majors", the spread of this instrument at most brokers is from 3 pips.

The currency pair GBP/USD is considered one of the most aggressive ones in the Forex market. Because the pound is quite heavyweight, it provides cross-courses with its participation, particularly GBP/USD pair, with intense volatility. Its behaviour is quite unpredictable and notable for false breakdowns of support and resistance levels.

The volatility of the GBP/USD pair can go up to 130 pips per session. This pair is often traded in the European and American sessions. As a rule, London trading sessions are more dynamic and active. The lowest liquidity for this pair is observed during the Asian session, on average about 30 pips. Therefore, beginners should trade in this time interval.

This financial instrument is more interesting for traders oriented to "fast" operations, i.e. scalping, because the high volatility of the pair allows making short-term deals during the day, aiming at a quick profit.

Today the currency pair GBP/USD has a lot of interest among traders, and many traders favour trading in this currency pair.

How to start trade GBP/USD in the Philippines?

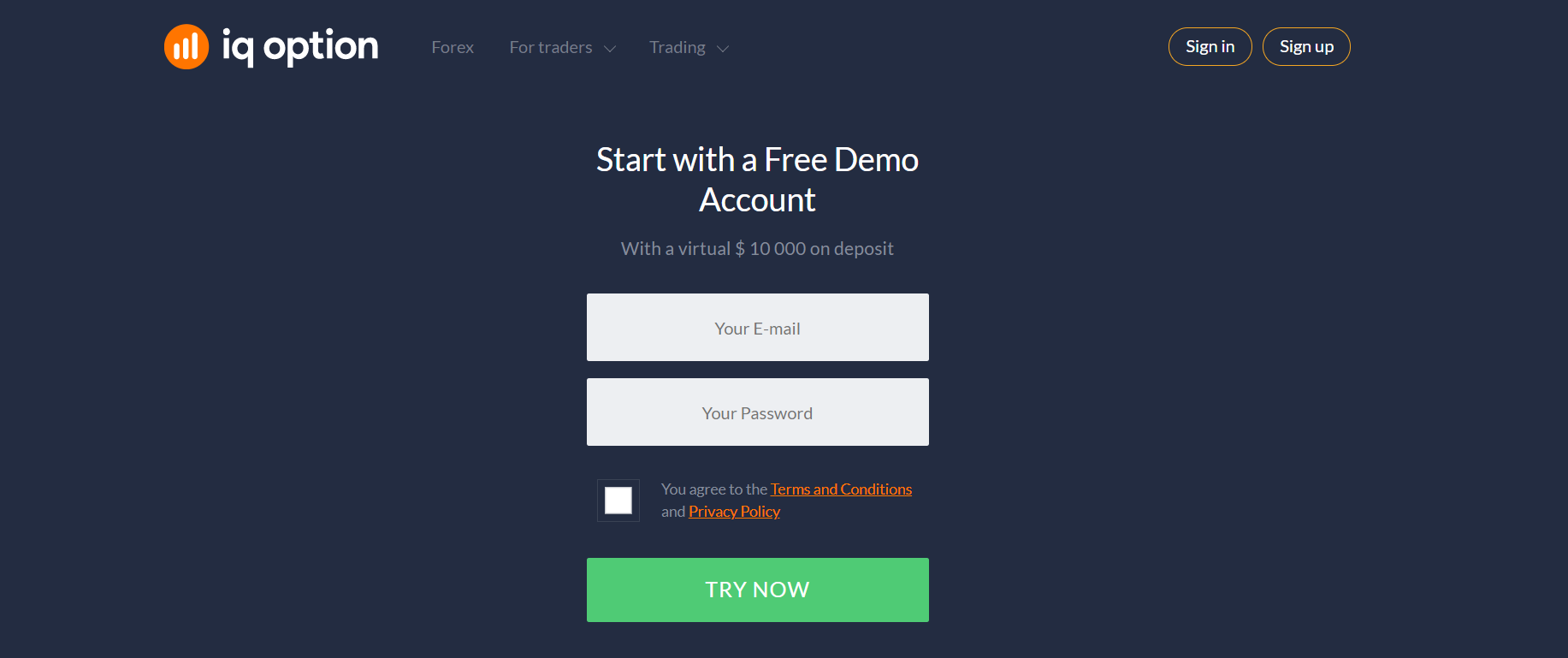

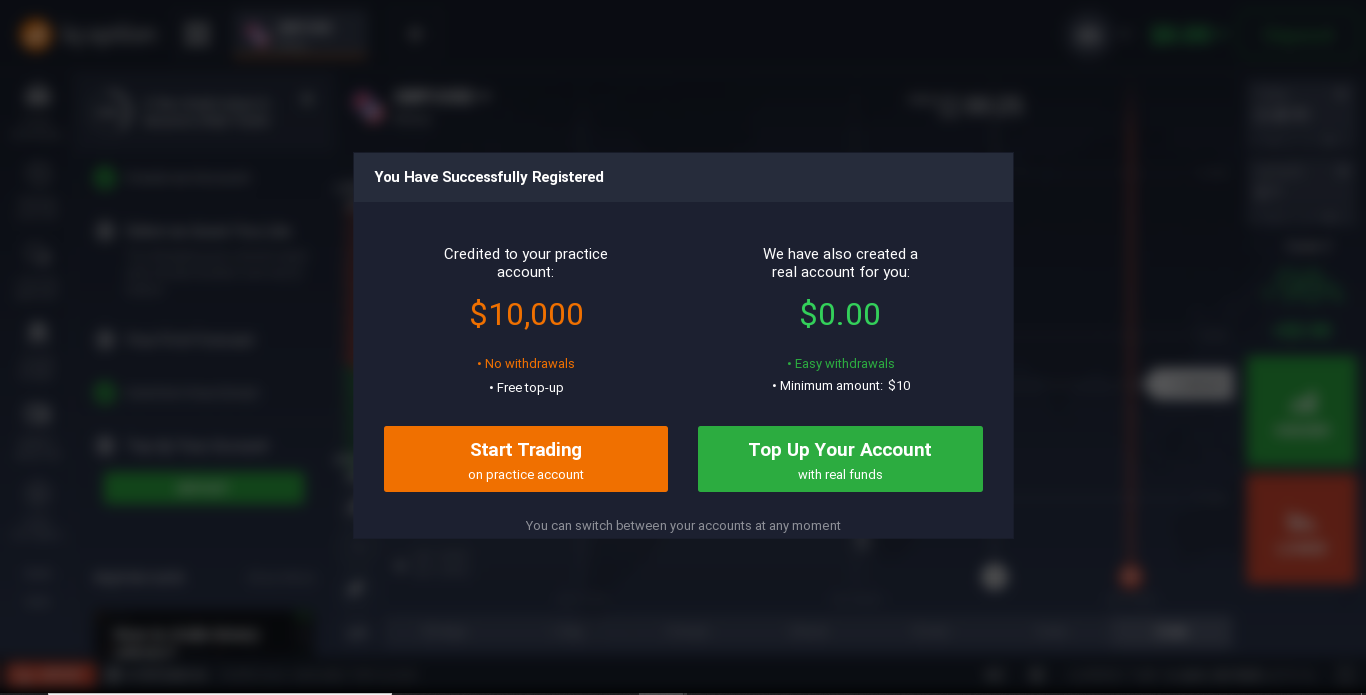

If you are interested in trading GBPUSD and want to start trading, you have to choose a platform and register. Registration is quick and easy. To register, you need to enter some personal information so that you can be identified.

Demo account

The best option is to gain experience with trading in a demo account. The trader of the market keeps a diary of events and records statistics on the contracts. After getting the starting skills, the trader is ready to start actual trading.

Real account

Once you have mastered your skills on a demo account, you will feel like it's time to start trading for real. In that case, you'll need to open a real account. To do that, make a minimum deposit and begin your journey into the career of trading.

If you keep the risks in mind and learn all the time, you will always be successful. Good luck with trading!