Characteristics of the currency pair EURUSD

The EURUSD currency pair is the most common among traders. Euro/Dollar is one of the most popular on the market. The convenience of working with EUR/USD is due to the excellent accessibility to all news that in one way or another affect the current quotes.

The importance of currency pairs?

Currency pairs in the market are the main financial instruments for trading on the exchange, which traders or investors buy and sell in order to make a profit. Each currency pair consists of two parts two types of currencies that are traded relative to each other, interacting.

The concept of a currency pair is widely used in Forex to simplify the trading process, since when buying one currency, a trader always gives another (as it turns out, sells).

The type of definition of a currency pair is accepted in international trade and always assumes the same designation first, the base currency is written, the quoted currency is indicated through a slash. So, if we take, for example, the Euro/Dollar currency pair and the quote 1.25, then this means that for one euro you need to pay 1.25 US dollars. It turns out that by buying this currency pair, the trader is buying euros for dollars.

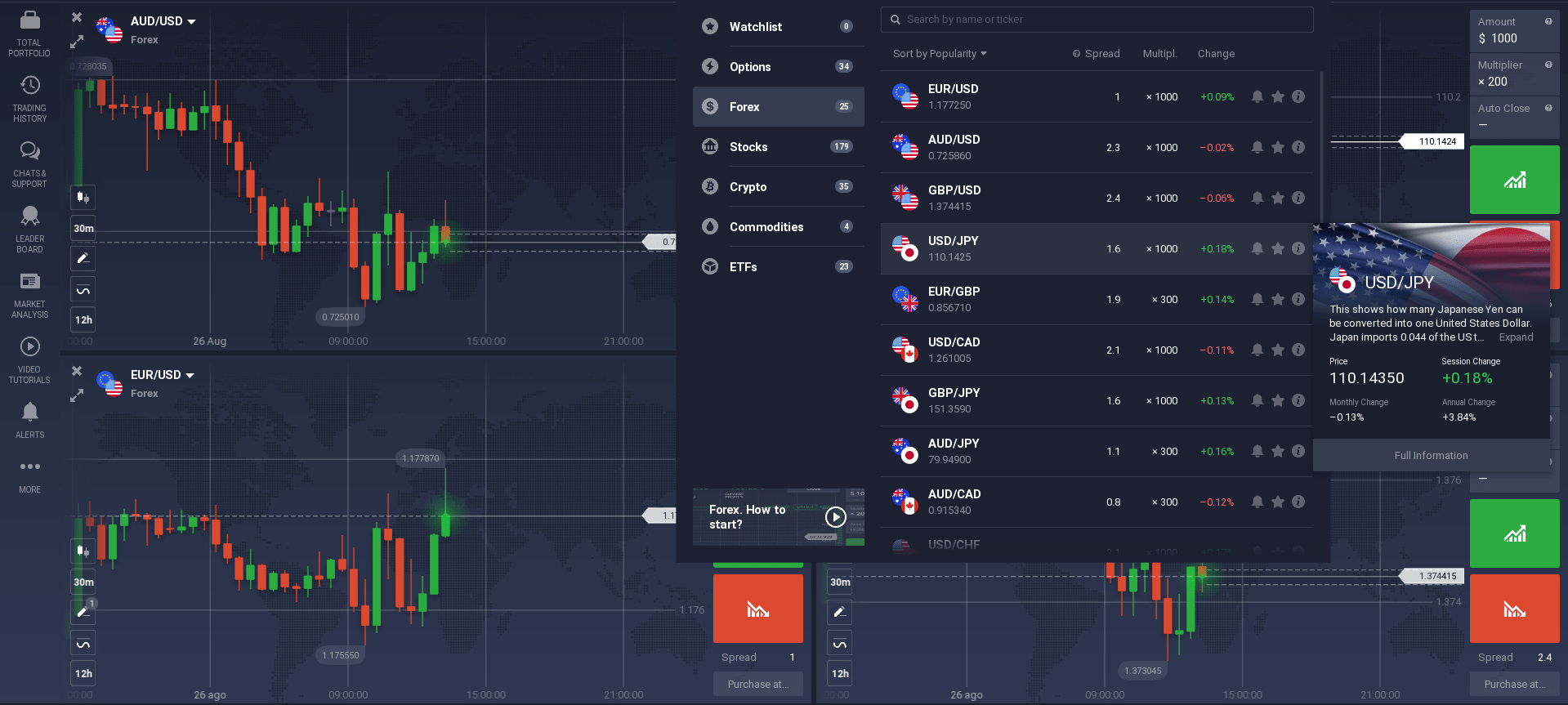

There are three types of currency pairs. Most traders prefer to work with the major ones, some trade cross rates and it is very rare to find those choosing exotic pairs. However, you can trade on the market with any of the listed assets.

| Couples | Explanation | Examples of pairs | ||

| Basic pairs | Those pairs that include the US dollar. As a rule, these are the currencies of the most significant countries from the point of view of the economy. | US dollar and Euro, US dollar and Swiss franc. | ||

| Cross-courses | Pairs in which the US dollar is not present. They are usually less active than the main ones. | Swiss franc and Japanese yen, Euro and British pound. | ||

| Exotic couples | National currencies of small countries. These assets are traded very rarely, usually with small volumes and minimal liquidity. | US dollar and Mexican peso, US dollar and Russian ruble, euro and Danish krone. |

When thinking about which currency pairs it is more profitable to trade, it is worth considering a lot of factors: knowledge, skills and experience in trading, personal preferences. Usually, beginners are advised to choose the main pairs as the most popular and understandable - many strategies, indicators, other tools have been created for them, there is a lot of theoretical information, examples of trading by more experienced masters.

Exchange rates

Exchange rate - the price of a unit of the currency of one country, expressed in units of the currency of another country.

There are two main exchange rate regimes: a floating exchange rate regime and a fixed exchange rate regime.

| Floating | Fixed | |

| They call such an exchange rate that is set in the currency market as a result of the interaction of supply and demand. | If the Central Bank directively sets the exchange rate either at a certain level or in a certain range. |

Factors affecting the change in the exchange rate can be divided into short-term, medium-term and long-term.

| Name | Short-term factors | Medium-term factors | Long-term factors | |||

| Factors | Conditions affecting the exchange rate at a particular moment, and they include current news, market sentiment, following various trends. | Capital flows and real interest rates have effects on the foreign exchange market that can last from several weeks to several months. | Among them, it is worth noting purchasing power parity, the country's savings and investment balance, foreign assets, productivity dynamics and sustainable trade trends. All of them have a lasting impact on the exchange rate. |

Trading sessions

A trading session is the time of trading on a specific exchange or stock exchanges in one region.

For any exchange in the world, there are established opening hours - this is the period of the main trading session during which official trades are held. The exchanges are open every day from Monday to Friday.

Trading in the market lasts 24 hours a day. However, traders and investors take into account the main trading hours of the world exchanges, as this affects the volatility of instruments associated with a particular region.

A trading session can be divided into several phases:

| Premarket | Postmarket | |

| A trading period organized before the main market session. It usually has lower liquidity than during the main session, higher volatility, and higher spreads. | A trading period organized after the main market session. The risks of trading on the postmarket are similar to those of the premarket (in particular, low liquidity). |

Features of trading during sessions

During the Pacific session, assets are flat and are suitable for channel strategies.

During the European and American sessions, quotes are very mobile and are perfect for trending strategies.

During the Asian session, the market is moderately volatile and is suitable for almost any trading style.

| Pacific | Asian | European | American | |||

| Its distinctive feature is that it is the lowest volatility and one should not expect any sharp jumps. | Activity in the foreign exchange markets is insignificant, but increasing. Typically, the Asian exchange sets the trend for the whole day. | An important feature of the European trading session is that it partially overlaps with the Asian session at the beginning, and at the end with the American one. Throughout the entire trading session, there is high volatility and the range of trading instruments that can be traded increases significantly. | It is extremely volatile and aggressive, as market participants pay great attention to the release of news. During the American session, the previously formed trend can be either continued or reversed. There is high trading activity during the American session. | |||

| Popular assets are currency pairs with USD. | Popular assets are currency pairs that include JPY. | One of the most popular assets are currency pairs, which include EUR, GBP, CHF. | Particular attention is paid to currency pairs in which there is USD and CAD. |

Trading timeframes

Timeframe is the period of the chart of the price of a financial instrument. If we talk about the chart in the form of Japanese candles, then each individual candle on it represents a period of time equal to the timeframe.

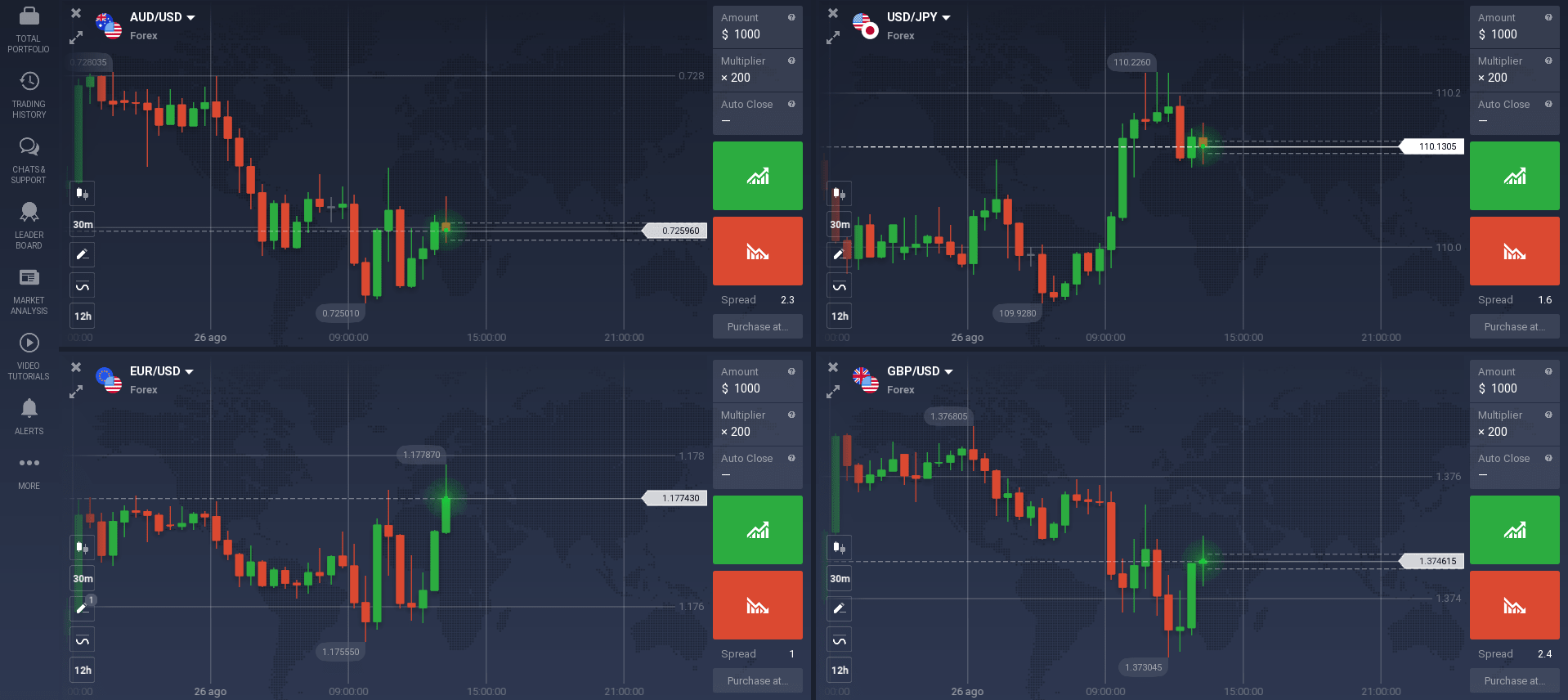

When trading the market using the terminal, the following timeframes are used:

- M1 - minute;

- M5 - five minutes;

- M15 - fifteen minutes;

- M30 - thirty minutes;

- H1 - hour;

- H4 - four hours;

- D1 - day;

- W1 - weekly;

- MN - monthly.

Trading strategy

Trading strategies that work on the market are, as a rule, a clear trading algorithm indicating the conditions for entering and exiting the market. Such manual developments allow minimizing the risks of serious losses while obtaining the maximum possible profit. At the same time, specific strategic mechanisms help to neutralize potential losses. In all cases, the trader must have several strategic plans in stock, used in accordance with the current objective conditions.

When it comes to trading currency pairs on the exchange, the trader can choose from a fairly large assortment of ready-made strategic solutions, each of which must be adjusted for the specific conditions of the upcoming trade.

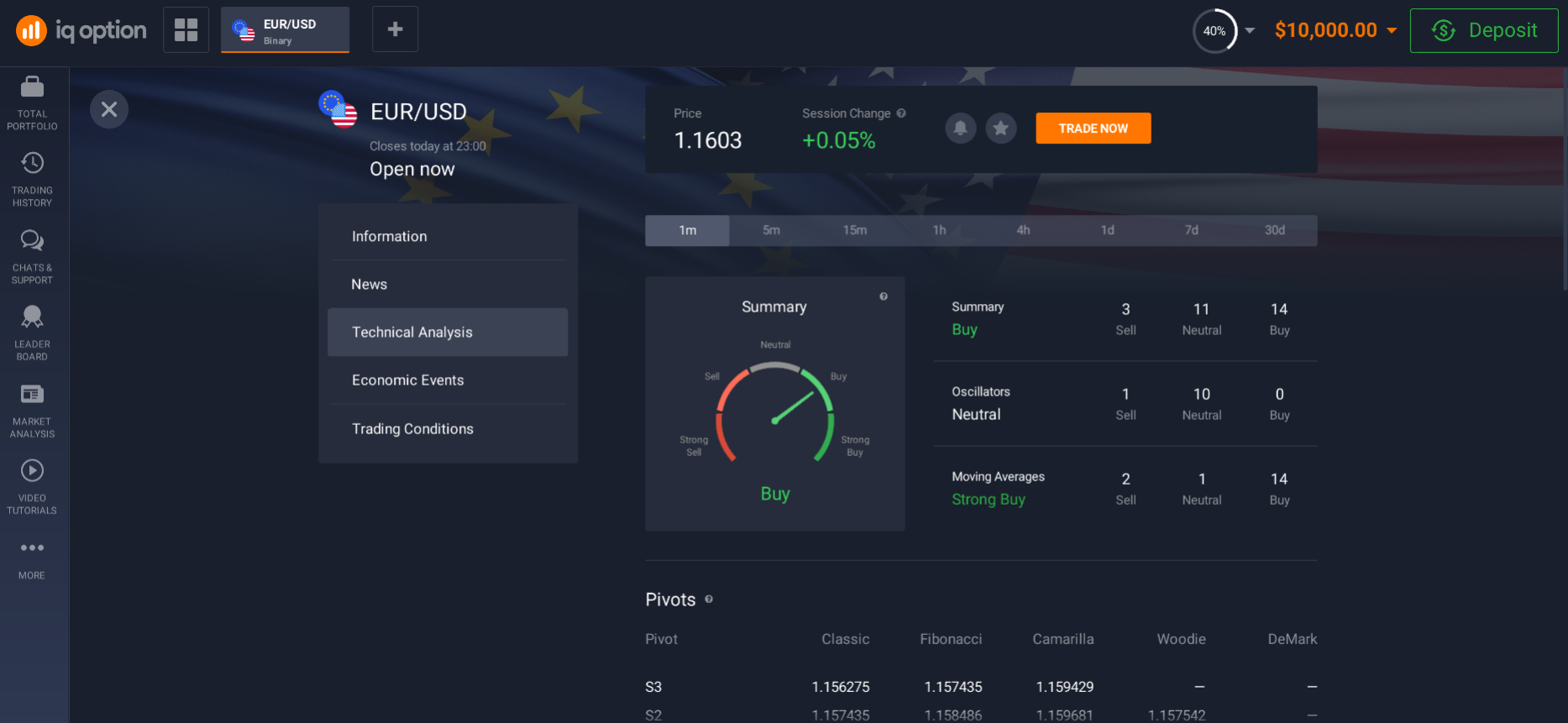

Trading strategies can be based on:

| Technical analysis | Fundamental news | |

| Used to evaluate investments and identify trading opportunities by analyzing statistical trends collected from trading activities such as price movement and volume. | Qualitative and quantitative information that contributes to the financial or economic well-being of a company, securities or currency, as well as their subsequent financial assessment. |

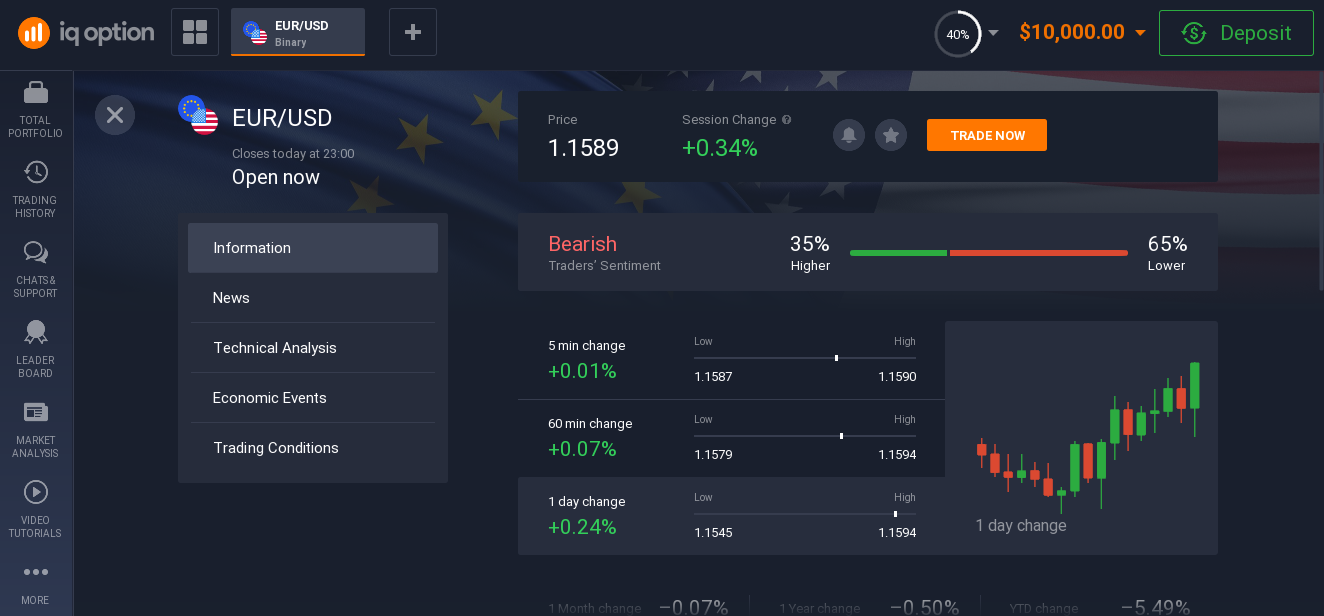

Features of the EURUSD

The leader in the world market is the EUR/USD (euro/US dollar) currency pair, which is actively used on the trading floors of all countries except Asia, where interest in this pair is slightly lower than on the markets of the United States and Europe.

Any pair has its own characteristics and EUR/USD is no exception. Having analyzed in more detail the peculiarities of its movement, it is possible to slightly increase the trading efficiency (at least due to the fact that some of the false entries can be discarded).

The EUR/USD pair belongs to the main currency pairs and is characterized by increased liquidity. This is not surprising since it includes two of the world's major reserve currencies: USD and EUR. It is in the Euro / Dollar that the largest volume of transactions is made during daily trading on the market (approximately 20% of the total volume).

The EUR/USD currency pair is still quite young, its trading life began quite recently - in 1999. But despite its youth, this pair confidently took first place in terms of the volume of transactions on Forex. Due to its enormous liquidity, availability and low spread, the pair enjoys a well-deserved popularity among traders. First you need to decide on a suitable trading method for you and work it out.

How to start trading EURUSD in the Philippines

Before you start trading, you need to make sure the trader is ready. You can't just come to the market and start making money without any knowledge. When an untrained person starts to trade, there is a high probability that he will lose all his invested funds. That is why there are many educational articles and video tutorials with which you can make out the main thing what not to do when you start trading, namely:

- To enter the market unprepared. This also applies to knowledge of the selected asset and knowledge of the system with which it is planned to make a profit.

- Invest all personal funds. It will be more correct to start small and gradually increase the volume. The first investment is always risky, so it is worth investing as much as you are not afraid to lose. But at the same time, it is important to remember that there will not be a large profit from a small contribution. The larger your portfolio, the more profit.

- Not improving knowledge. Also, do not limit yourself to introductory knowledge, the more a trader knows, the more likely his transactions will be safe and bring stable profits.

When a trader chooses a investment platform, he must make sure that it is valid and has a license. You can simply read reviews from other traders who have been familiar with the platform for a long time. You also need to be careful when choosing a site, so as not to stumble upon scammers.

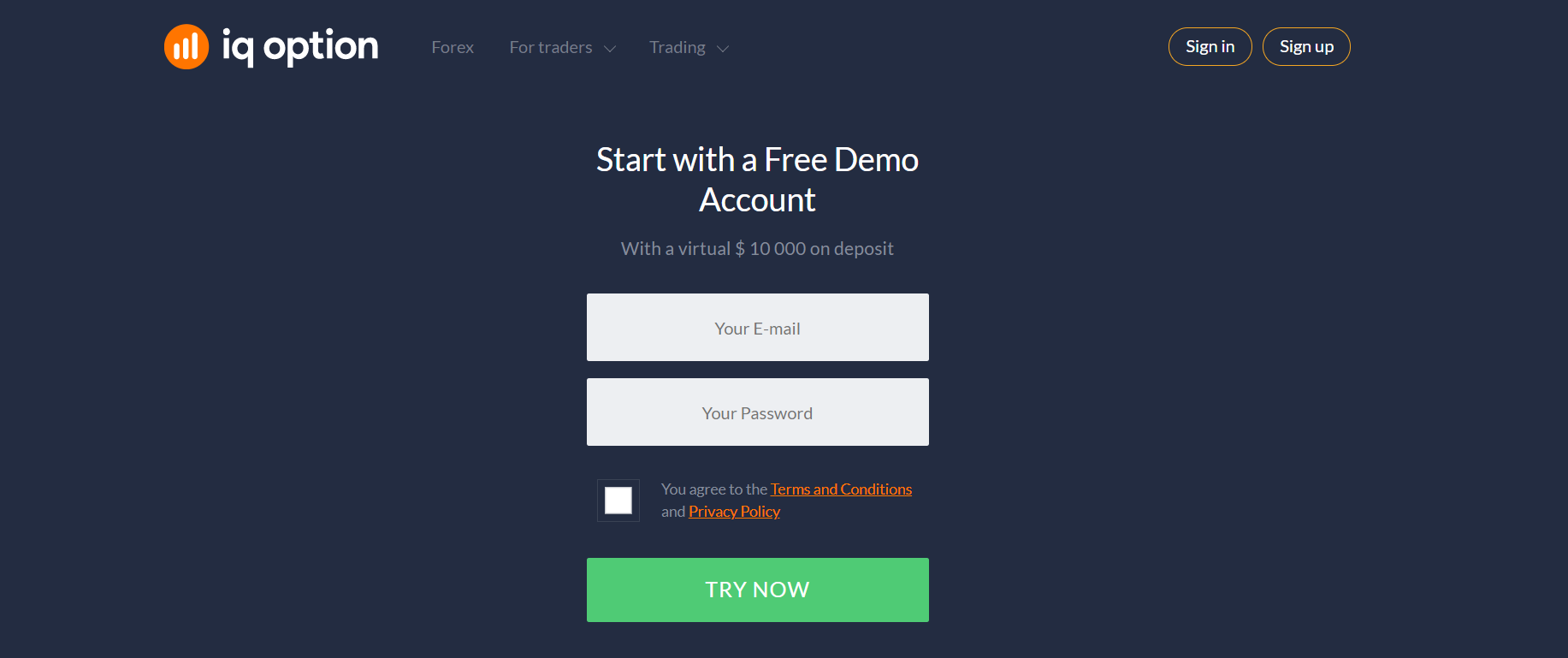

After choosing a site, you need to go through the registration and verification process, this is done for the safety of the trader's personal data and his personal funds, which bow in the partfel.

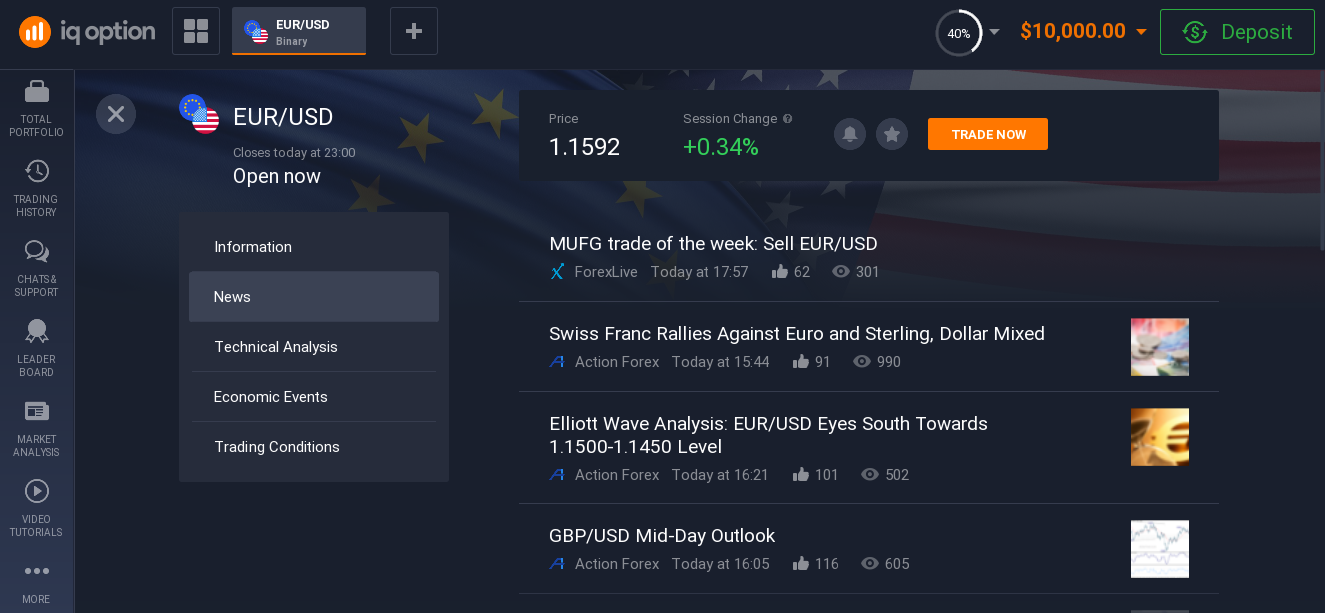

After registration, a trader can test the site and understand its functionality using a training account. Such an account is provided by the online broker itself, for practicing strategies or for training newbie traders. You can return to this account any time after the start of real trading.

Once the trader is confident in his abilities, he can switch to a real account. To do this, you need to make an initial deposit. You can deposit, as well as withdraw funds using bank transfers. Which makes trading even more accessible for any person.

Today, trading is considered a very popular way to get active or passive income (depending on how much time a trader spends on trading), all you need is Internet access and some free time to start.

How to become a successful trader

To become successful in trading, you must follow a few tips:

- Do not dwell on one strategy, try something new.

- Consider working with multiple assets. This will diversify the trading process and make it more interesting. And while enjoying your work, you can reach great heights.

- Do not stop trading if you fail, go back to developing a strategy, correct it or replace it.

- In order to reduce the loss of funds in moments of failure, do not open rash deals.